Thales Expands Cybersecurity Portfolio With OneWelcome Acquisition

Last week, Thales announced that it had the signature of an agreement to acquire OneWelcome, a European leader in the fast-growing market of customer identity and access management (CIAM), for a total consideration of €100 million. Thales aims to capitalize on OneWelcome’s strong cloud-native software-as-a-service (SaaS) product by extending its market footprint beyond Europe and selling it to existing Thales clients in North America and the Asia-Pacific region.

Complementary Identity Acquisition

OneWelcome’s strong digital identity life-cycle management capabilities will complement Thales’s existing identity services (secure credential enrollment, issuance and management, know your customer etc.). With this acquisition, Thales will be able to provide an expanded identity platform that will:

- Be accessible to organizations of all sizes to manage internal and external identities

- Quickly bring new businesses online

- Improve operational efficiency and customer experience

- Meet or exceed regulatory compliance requirements

It does look like CIAM is disappearing as a stand-alone pillar and is becoming a major pillar within larger vendors expanding cybersecurity portfolios. In addition to Thales’ acquisition of OneWelcome, other notable ones include:

- Ping Identity acquired Unbound ID in 2016.

- SAP bought Gigya for $350 million in 2017.

- Akamai acquired Janrain in 2019.

CIAM of Interest to Technology Vendors in Various Sectors

It’s interesting that these acquisitions don’t follow a pattern. Thales is arguably the biggest vendor in data security with its encryption capabilities. Ping was already a significant player in enterprise identity management/IDaaS before it added CIAM, and SAP, of course, has a huge enterprise resource planning (ERP) and customer relationship management (CRM) business. And Akamai is a content delivery network (CDN) that has been expanding its security offerings for the best part of a decade.

What they have in common, however, is that the acquirers all serve enterprise customers who deal with large numbers of customers in the consumer market and their interactions with them have moved increasingly online, making CIAM a vital part of their security toolkit. Think of CIAM as the place where identity management (IAM and IDaaS) meets CRM, enabling consumers to access online resources and learning from their behaviors to improve their experience and, hopefully, to drive more sales.

Data Security and CIAM Convergence

Thales is a major player in the data security space and the acquisition of OneWelcome helps it expand its identity portfolio.

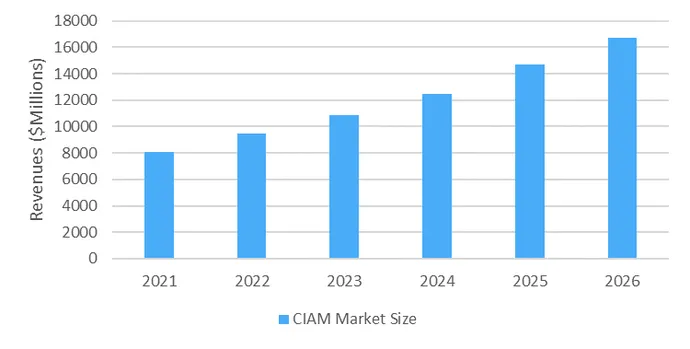

It does seem that an increasing number of vendors are wanting to play in the identity space. Only last month, Microsoft expanded its capabilities in identity with the launch of Entra. The good growth potential of CIAM and clamor by big vendors to enter this space can help to explain why Omdia projects this market to increase from $8.1 billion in 2021 to $16.7 billion in 2026.

Read More HERE