PayPal rolls out new fraud management tools for merchants

PayPal is launching a new suite of fraud management features for mid-market and enterprise businesses that aims to help combat the rise in online payments fraud brought on by the pandemic.

The COVID-19 pandemic spurred unprecedented growth in online spending in 2020, with e-commerce penetration reaching an all-time high of 21.3% — the highest year-over-year jump for US retail sales ever recorded, according to estimates. But the spike in e-commerce and digital payments also led to an increase in online scams, sophisticated attempts at fraud by malicious actors and new operating risks for online businesses.

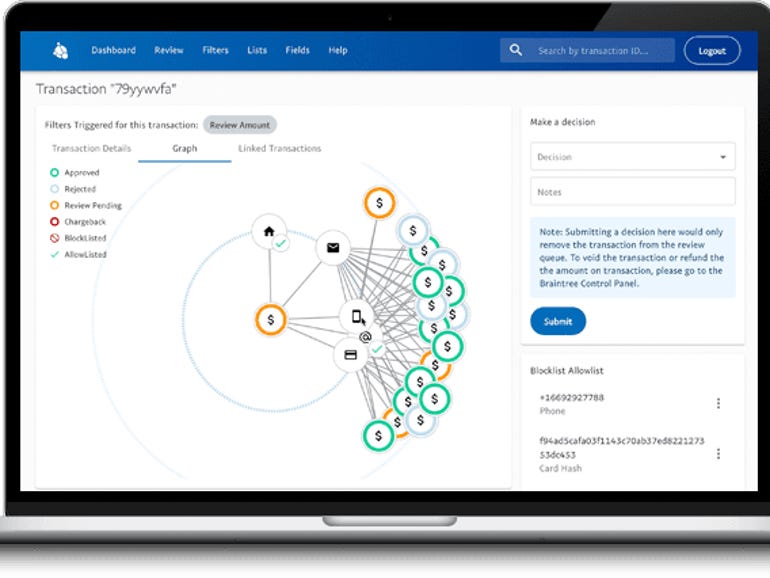

According to PayPal, its new Fraud Protection Advanced service uses device fingerprinting, machine learning and analytics to help businesses identify, investigate, resolve and mitigate fraudulent transactions.

The technology allows for real-time data modeling to help businesses spot shifting fraud patterns, and enables high fraud decisioning performance that can lead to lower chargebacks and false declines. Additional improvements include the ability to customize filters and fields in an effort to reduce a merchant’s exposure to fraud and help them differentiate between legitimate and non-legitimate transactions.

Overall, PayPal is pitching the improved service as a way for merchants to increase their authorization and conversion rates.

“Fraud Protection Advanced builds on our existing Fraud Protection solution and is part of our larger suite of offerings for merchants in the PayPal Commerce Platform that help them to manage risk and payments,” PayPal wrote in a blog post. “As we build on these solutions, we will continue our commitment to democratizing access to critical tools and resources for all merchants that help better protect their businesses.”

RELATED:

READ MORE HERE