With Plunge in Value, Cryptocurrency Crimes Decline in 2022

The dramatic decline in cryptocurrency has dampened activity around specific types of financial crimes — most significantly, investment scams and illegal Dark Web transactions — leading to a drop in consumer losses for the first half of 2022.

That’s according to an analysis published on Aug. 16 from blockchain data provider Chainalysis.

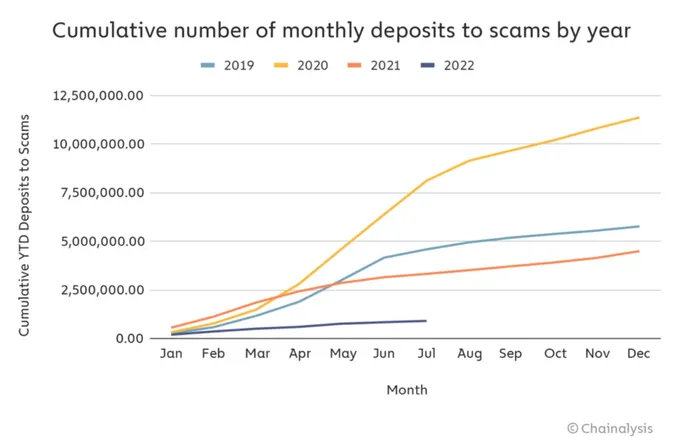

Overall, the cumulative revenue collected by scammers dropped by two-thirds — 65% — for the first seven months of the year, according to the firm. The decline is only partly linked to the decrease in the value of major cryptocurrencies. Bitcoin, for example, plunged in value by 51% between Jan. 1 and July 31, and that still doesn’t account for the total drop.

The number of deposits connected to scams also dropped by more than two-thirds, suggesting that fewer consumers were falling prey to those efforts, says Kim Grauer, director of research at Chainalysis.

“Most scams are investment scams, and if investments across the board are down, then less funds will flow to the services that are, in fact, scams,” she says. “We also saw a lot of law enforcement wins in the past year which have further deterred scammers.”

Since their peak last November, major cryptocurrencies have dropped precipitously in value, reaching lows in June. Bitcoin dropped nearly 72%, from its $67,567 close on Nov. 7, 2021, to $19,018 on June 17. Similarly, Ethereum plunged nearly 80% to close at about $994 on June 17. Both digital assets have recovered from those lows in the past two months.

Cryptocurrency is the financial backbone of most online crimes, Chainalysis stated in its midyear update, so the drop in cryptocurrency has impacted other major cybercrimes, such as money laundering and ransomware. Both have dropped by 20% to 25% since the beginning of the year, according to cybersecurity firms.

That said, crimes that do not depend on enticing victims with cryptocurrency have been less affected by the volatility. Business e-mail compromise (BEC), for example, still accounted for 35% of the dollar losses in 2021, compared with 0.7% for ransomware, according to the FBI’s Internet Crime Complaint Center (IC3).

“Nobody likes a crypto bear market, but the one silver lining is that illicit cryptocurrency activity has fallen along with legitimate activity, albeit not as sharply,” the company stated. “This is especially encouraging in scams, where the decrease in market hype seems to mean fewer are fooled by scammers, and in darknet markets, where law enforcement’s [shutdowns of major markets] appears to have dampened the entire sector.”

DeFi Services Still Hot Targets

One constant? Hacking of digital wallets and decentralized financial (DeFi) services continued to grow. Overall, cybercriminals stole at least $1.9 billion in cryptocurrency through hacking online services so far in 2022, an increase of about two-thirds from the same period in 2021.

The majority of the hacking profits comes from hacking DeFi protocols, Chainalysis stated in the mid-year report.

“DeFi protocols are uniquely vulnerable to hacking, as their open source code can be studied ad nauseum by cybercriminals looking for exploits — though this can also be helpful for security as it allows for auditing of the code,” the company stated. “[I]t’s possible that protocols’ incentives to reach the market and grow quickly lead to lapses in security best practices.”

Specific regions have also focused on specific types of crime. North Korean nation-state actors have compromised specific DeFi protocols, leading to massive gains for the sanctioned government. The attackers stole approximately $1 billion so far in 2022, accounting for the majority of the $1.9 billion in losses from exchanges and services, as of July 2022.

“We have seen ransomware attacks coming out of North Korea, but right now DeFi hacking is the most profitable thing for the North Korean hacking organizations to carry out,” Grauer says. “North Korean hacking organizations have realized how profitable this type of hacking can be if done correctly, so have continued to carry out attacks throughout 2022.”

Financial institutions, consumers, and cybersecurity professionals should not expect the decline in fraud related to cryptocurrency to continue, Chainalysis stressed. Consumers need to be better educated about the risks, while the cybersecurity of decentralized financial protocols needs to be bolstered and audited. Finally, legitimate exchanges should have protections in place to prevent the transfer of money to known scams, and law enforcement should develop their capabilities to seize cryptocurrency from bad actors, the company stated.

Read More HERE